Peach Education Tax Credit

Put Your Taxes to Work

for Construction!

Apply

Visit the GFPE website to complete the application.

You’ll receive approval from The Georgia Department of Revenue (GaDOR) within a few days of submitting the application.

Donate

Make your donation within 60 days from the date of approval and before the end of the calendar year to receive your dollar-for-dollar tax credit the following April.

To designate the funds for Construction Ready, be sure to select Innovation in Construction Education.

Once approved, you can donate online or by mail.

Claim

To claim the tax credit on your state income taxes, complete Form IT-QED-TP2 and attach it to your income tax return.

It is a simple and rewarding way to improve our state by increasing educational opportunities for Georgia’s 1.7 million publicly schooled children. The tax credit that you earn ensures that your dollars will go to work exactly where you want them.

Contribution Limits Based on Filing Status:

$2,500 | Single Individual, Head of Household, or Married Filing Separately |

$5,000 | Married Filing Jointly |

$25,000 per member | Pass-through income from LLC, S-Corp, or Partnership* |

75% of total GA tax liability | C-Corp or eligible Trust |

Step 1

-

Check your previous tax return to review how much you paid in Georgia State Taxes last year. If you used an accountant, give them a call—they are aware of the Peach Education Tax Credit and can assist you.

-

Determine the amount you are comfortable donating, and make sure it is equal to or less than the contribution limit based on your filing status. (see chart above)

-

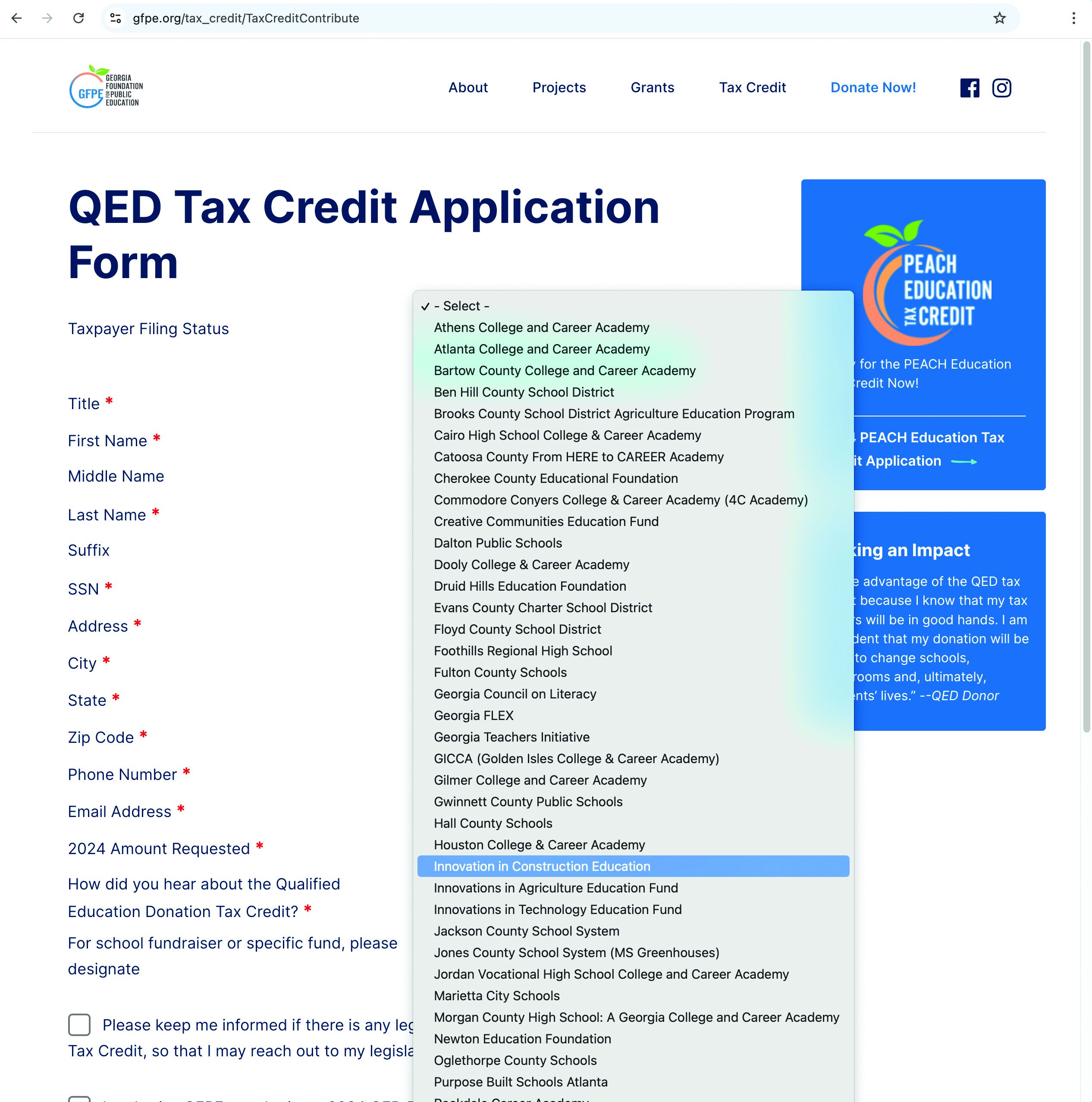

Apply for the tax credit through Georgia Foundation for Public Education (GFPE) at www.gfpe.org/tax_credit. Complete the application, and in the “For school fundraiser or specific fund, please designate” dropdown, choose Innovation in Construction Education.

-

Within a few days of submitting the application, GFPE and the Georgia Department of Revenue (GaDOR) will notify you via email that your application and donation amount has been pre-approved and provide a link to your account.

Step 2

-

To pay online, visit www.gfpe.org/tax_credit/PEACHPayment. Follow the instructions and make your donation to GFPE before the payment deadline—60 days after receiving your pre-approval and prior to the end of the calendar year. Again, designate your donation to Innovation in Construction Education.

-

If you prefer to donate via check, make payable to the Georgia Foundation for Public Education, and mail to:

Georgia Foundation for Public Education

205 Jesse Hill Jr. Drive SE

2062 Twin Towers East

Atlanta, GA 30334 -

Within one week of receiving your donation, the GFPE will send you Form IT-QED-FUND1, which serves as the receipt for the donation and proof of tax credit.

Step 3

-

To claim your dollar-for-dollar tax credit, attach Form IT-QED-TP2 to your Georgia Tax Return next year.

Note: GaDOR requires e-filing for all tax credit forms.

Questions?